Platinum: The Quiet Metal With Loud Potential

Not gold. Not bitcoin. A forgotten reserve asset hiding in plain sight.

By Marjorie F. Nadal | May 15, 2025

Disclaimer: This is not investment advice. I have no current ties to the World Platinum Investment Council (WPIC), nor do I receive any compensation for this commentary. All views expressed are my own.

Everyone expects me to write about gold.

Fair enough. I used to be a gold options market maker. Gold is at an all-time high. Central banks are accumulating it like it's going out of style. I should have something to say.

But I'm a contrarian. So I'm writing about something else: Platinum.

So Why Not Gold?

Gold makes sense right now—geopolitically, symbolically, and even systemically. But that's also why it's crowded. Everyone has a reason to own it. Everyone has a theory to justify the price.

Could it go higher? Yes. Could it go much higher before it crashes? Also yes. Could it become part of a future monetary standard? Unlikely—but not impossible.

But if we're discussing reserves, not trades—if this is a letter to long-term allocators, not speculators—then we need to consider what's next.

That brings us to platinum.

A Personal History With the Metal

Years ago, I worked alongside an institution trying to promote platinum as a strategic asset. The timing was brutal. A speculative rally had just imploded. Volatility spooked everyone. Liquidity vanished.

I still remember the look on my colleague's face when I held a 10,000oz long position in XPT in 2008. I was fine. He looked like he'd seen a ghost. That's what 10,000oz of platinum exposure will do to some people.

In the aftermath, platinum sank into obscurity. It became a tiny, esoteric market—except in South Africa, where the central bank continued to support it and ETFs in Rand quietly gained traction. For a time, it even traded below palladium, a metal with far less strategic pedigree.

That has changed. Slightly. But the market still hasn't recovered its status.

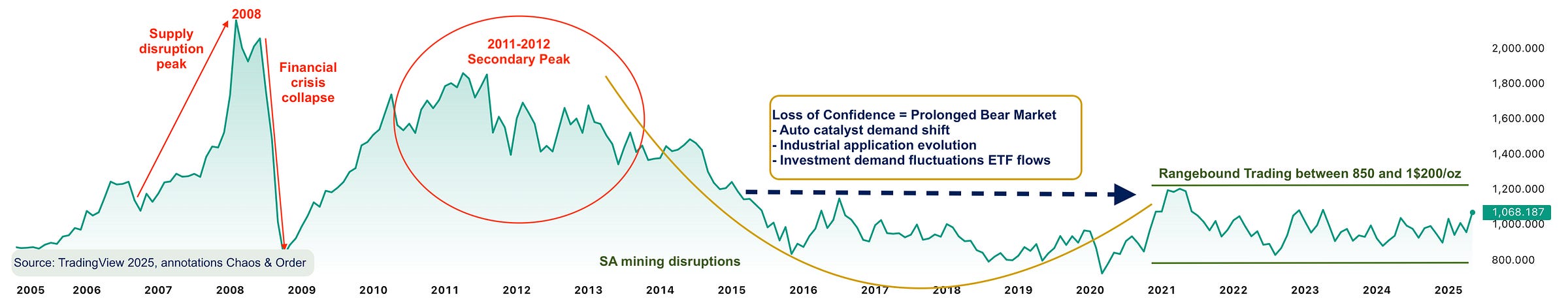

Platinum's price peaked in 2008, collapsed, and has yet to regain that level.

The question is: why? And what happens if it does?

What Makes Platinum Interesting Now

1. It's physically remarkable

Dense, malleable, corrosion-resistant, and discreet. I once held a 1kg platinum ingot in a Zurich vault. It was no larger than a bathroom tile—but shockingly heavy.

A reminder that value doesn't always need volume.

2. It has a strategic industrial future

Platinum is a critical enabler of the hydrogen economy. It's used in PEM fuel cells, which power hydrogen vehicles, and in electrolysers, which split water into hydrogen and oxygen.

As governments and industrial players ramp up green hydrogen initiatives—from Europe's REPowerEU plan to U.S. Inflation Reduction Act subsidies—platinum demand could rise significantly. Unlike gold, which stores value symbolically, platinum stores value and powers transition infrastructure.

Hydrogen isn't just a buzzword—it's an emerging industrial backbone. And platinum is at its core.

3. It's discreetly held

The South African Reserve Bank already includes platinum in its reserves. Unlike gold, platinum doesn't attract headlines. It stores value quietly—something that might appeal in a world of financial surveillance and weaponised visibility.

4. It's historically underpriced

Relative to gold, platinum is trading at one of its lowest historical ratios. That's not just a statistic. It's a signal of neglect—one that long-term thinkers might find compelling.

The gold-to-platinum ratio is near historic extremes. Mean reversion could be violent.

Objections I Hear (and My Answers)

"It's too volatile."

Volatility is often a symptom of low participation. Broader adoption by institutional allocators would likely reduce that.

"It's too small—only ~170 tonnes annually."

Yes, but that's part of the appeal.

For comparison: gold production is ~3,600 tonnes per year, more than 20x platinum.

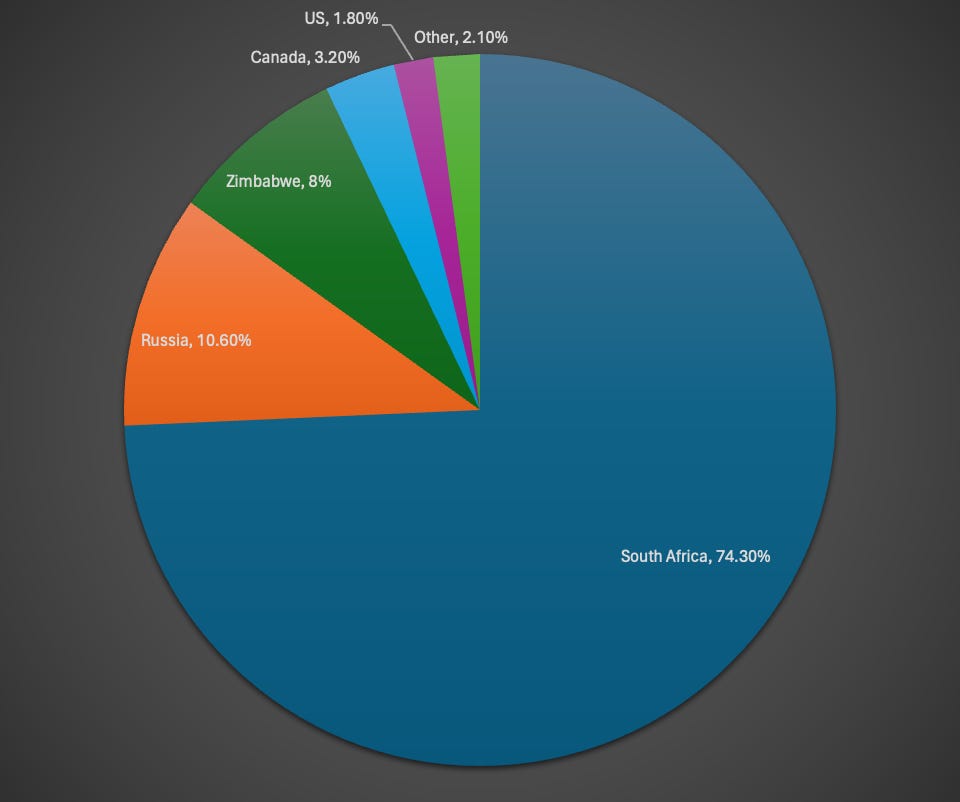

And unlike gold, over 70% of platinum supply is concentrated in South Africa, where energy shortages and labor instability routinely threaten output.

It's not just rare. It's precariously rare.

Even modest buying from central banks or large institutional allocators could have outsized price effects.

"It's illiquid."

It's thinly traded, not illiquid. And that distinction matters. Liquidity grows where interest goes.

Why Would Central Banks Buy It?

Central banks aren't momentum traders. They buy assets for three reasons:

to diversify away from politically risky reserves,

to hedge system instability,

and to signal independence from Western-dominated financial architecture.

In a multipolar world, platinum checks quiet boxes:

It's not dollar-denominated.

It's not controlled by the U.S. financial system.

It isn't politically loaded—yet.

That makes it especially appealing for reserve managers in BRICS nations, resource-rich states, or dollar-wary central banks.

The next wave of reserve diversification may not go to gold. It may go to metals that don't make headlines.

🧩 Jargon Decoder

ETF – Exchange-Traded Fund

PEM Fuel Cell – Hydrogen energy cell using platinum as catalyst

AUM – Assets Under Management

Electrolyser – Device that splits water into hydrogen and oxygen

COFER – IMF’s central bank reserve reporting database (platinum not included)

The Hydrogen Wildcard

Let me speak plainly about the hydrogen angle, because it's not just a bullet point, it's potentially transformative.

Remember how crude oil transformed from an industrial commodity to a strategic asset? Platinum could follow a similar path through its role in hydrogen infrastructure.

The global hydrogen market is projected to grow from $130 billion to over $600 billion by 2050.

Electrolysis—the process that creates green hydrogen—requires platinum catalysts. So do the fuel cells that convert hydrogen back to electricity.

This isn't speculative technology. It's already being deployed:

The EU has committed to producing 10 million tonnes of green hydrogen by 2030

Japan is building a "hydrogen society" as national policy

Major industrial companies from Siemens to Air Liquide are scaling hydrogen solutions

Each of these initiatives requires platinum. Not as a byproduct, but as a critical component.

What happens when energy transition planners realise their hydrogen ambitions depend on a metal with annual production smaller than the yearly output of a single large gold mine?

Where Is Platinum Actually Held?

Major platinum holdings remain concentrated in a handful of vehicles:

1. Exchange-Traded Funds:

PPLT (Aberdeen Physical Platinum Shares ETF)

LPPM (London Platinum and Palladium Market)

NewPlat ETF (South Africa)

But beyond these investment products, platinum is also widely held in the real economy.

Refineries, automakers, fabricators, and vaulting providers maintain significant inventories—often greater than ETF stockpiles.

These holdings are operational, not strategic. They don't show up in reserve data, but they shape the market just the same.

Over the past decade, the PPLT ETF gained over $460M in net assets. Some surges were price-driven—but others reflect real investor positioning.

Still, flows remain erratic, suggesting platinum has yet to earn a strategic place in most portfolios.

2. Strategic Reserves

Platinum is not tracked by the IMF. It doesn’t appear in official central bank disclosures.

Only South Africa has confirmed holding platinum as part of its reserves.

Others—if they hold any—don’t disclose it.

This makes platinum one of the most opaque reserve assets in the world.

Known Holdings

South African Reserve Bank (officially disclosed)

Russian State Reserves (unconfirmed but widely suspected)

A handful of other central banks or sovereign funds—if they hold platinum, they aren’t saying.

Platinum ETFs remain niche. That also means they’re under the radar—and potentially underpriced.

Closing Signal

Gold dazzles. Bitcoin disrupts. Platinum endures.

But it's not just endurance that matters now—it's optionality.

Platinum is an industrial metal with monetary potential. A store of value with utility. A quiet hedge on a noisy future.

In this multipolar moment—where supply chains are fragile, currencies are questioned, and energy is political—platinum might be the most overlooked reserve asset of the decade.

It's underheld, underpriced, and underestimated.

Sometimes, the best opportunities are the quietest.

And for those who appreciate fine craftsmanship—an example of the intricate, delicate work this remarkable metal makes possible.

Let's Discuss

Would you consider platinum in a long-term reserve portfolio?

Have you seen serious investor interest—or is it still too early?

Leave a comment or join the conversation below.

If you found this analysis valuable:

👉 Share it with a contrarian thinker

👉 Subscribe to Chaos & Order to receive future editions directly in your inbox. Sharp, strategic insight—never noise.

✨ About the Author

Marjorie F. Nadal is a former trading managing director and gold options market maker turned independent strategist. She writes Chaos & Order, a newsletter on commodities, power, and the architecture of volatility. Her work blends decades of market experience with macro analysis and an instinct for what others overlook.

#platinum #commodities #hydrogen #reserves #gold #centralbanks #bitcoin #macro #strategicassets #contrarianinvesting