Chaos & Order Edition 18: Central Bank Digital Currencies vs. Private Money

Second in "The New Money Architecture" series

CHAOS & ORDER BY M NADAL | SEPTEMBER 18, 2025

Disclaimer: This analysis represents personal observations and market intelligence. Views expressed are my own and do not constitute investment advice.

Last month, a central bank governor asked me what I thought about their digital currency pilot program. "We're finally catching up to the private sector," he said, referring to stablecoins and crypto payments.

I had to bite my tongue. The competition between CBDCs and private money isn't theoretical, it's already over.

In 2025, President Trump halted all US retail CBDC development while signing the GENIUS Act to regulate private stablecoins. The US chose private digital dollars backed by $120+ billion in Treasury securities. China deployed the digital yuan across hundreds of millions of wallets. Europe hedges with both the digital euro preparation and MiCA stablecoin regulation.

The battle lines are drawn: state-issued digital money versus private digital money franchised by states. Understanding this bifurcated outcome matters because it determines who controls the infrastructure that moves $5 trillion in global payments daily.

The 2025 Reality Check

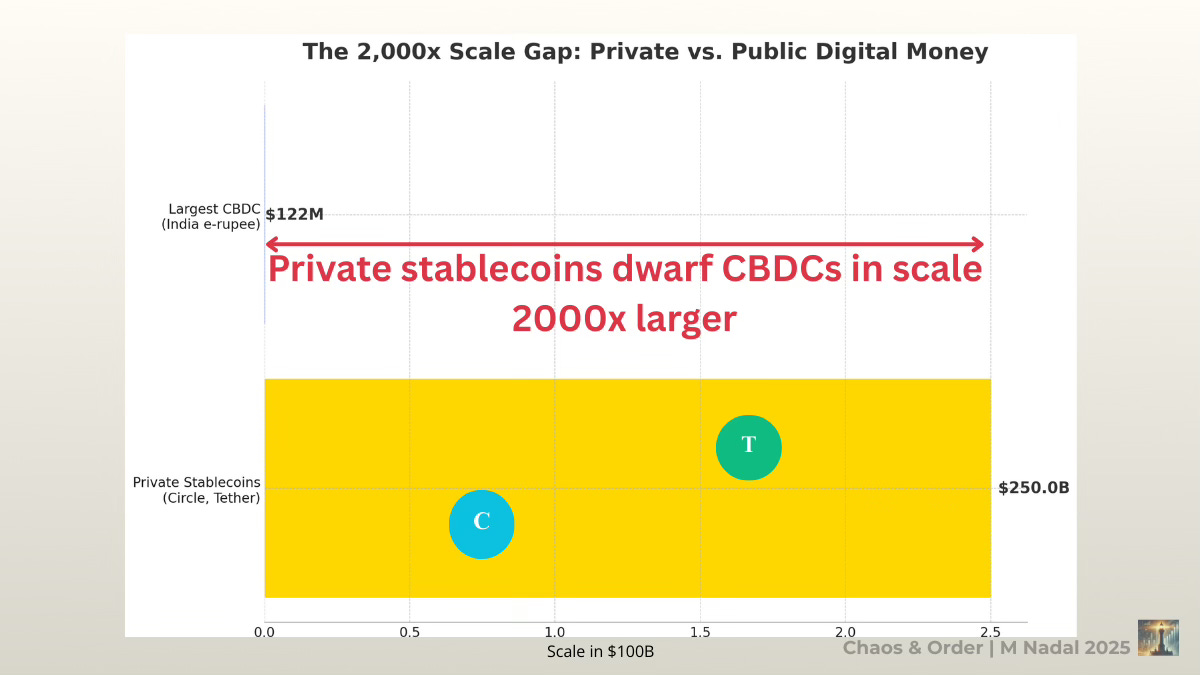

The numbers tell the story of a competition that's already been decided by scale:

Private Digital Money: Stablecoins command $250+ billion in market capitalisation, with 99% pegged to the US dollar. Circle and Tether collectively hold $120+ billion in Treasury securities, making them larger holders of government debt than most money market funds.

Central Bank Digital Currencies: 11 countries have launched retail CBDCs, with India's e-rupee reaching $122 million in circulation. That's a 2,000x scale difference.

Cross-Border Infrastructure: 13 wholesale CBDC projects, including China's mBridge connecting banks across Asia and the Middle East, process billions in cross-border settlements while bypassing traditional dollar-based systems.

The private sector won retail adoption. Central banks are competing for wholesale settlement control.

The Control Spectrum Reconsidered

Traditional banking operates on "delegated control": central banks set policy, commercial banks implement it, governments maintain ultimate authority through regulation. This system preserves the illusion of private markets while ensuring state control over monetary infrastructure.

CBDCs eliminate delegation, but differently depending on design. China's digital yuan provides complete government visibility into every transaction. European and UK designs build in privacy layers and holding limits to avoid surveillance state comparisons while maintaining monetary sovereignty.

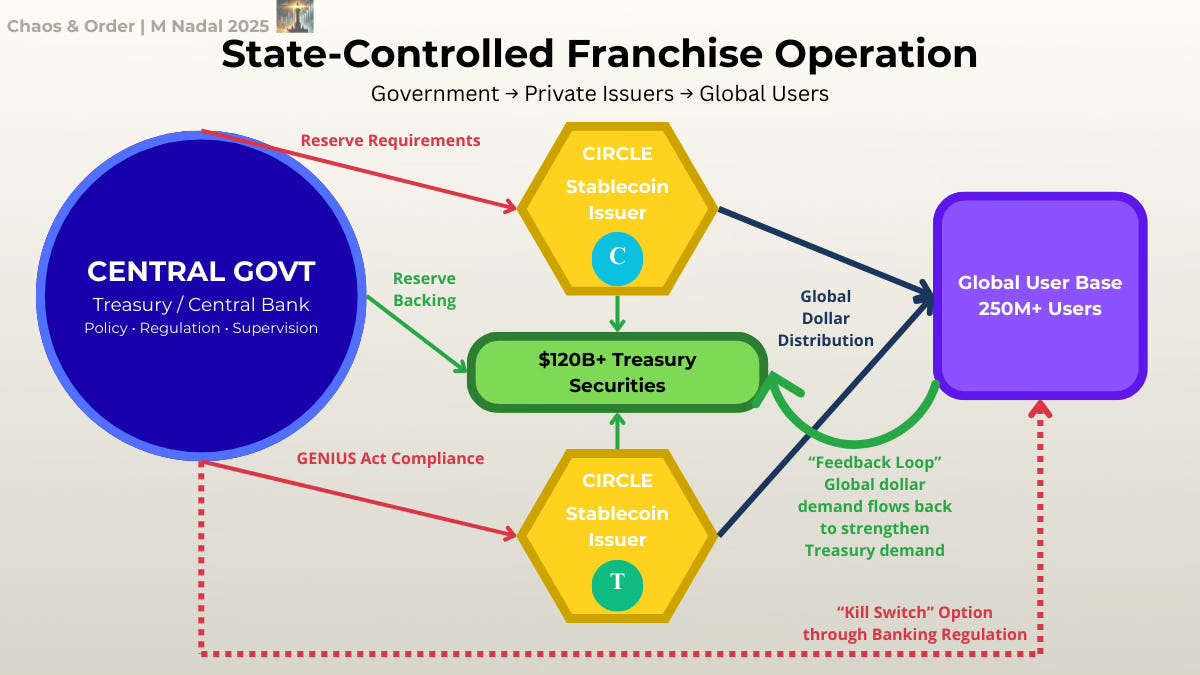

Private digital money operates on algorithmic rules rather than bureaucratic discretion… until governments decide otherwise. The GENIUS Act and MiCA regulation demonstrate how private issuers become "franchisees of central banks," following state-mandated reserve requirements, compliance frameworks, and operational standards.

The key insight: private digital money only works as long as governments find it useful.

The Weaponisation Strategy

The US didn't just tolerate dollar stablecoins. They weaponised them. With 99% of stablecoin market cap pegged to dollars and private companies holding $120+ billion in Treasuries, stablecoin issuers now market US monetary policy globally while Treasury maintains kill switches through banking regulation.

This creates unprecedented monetary leverage. Every international stablecoin transaction strengthens dollar dominance without requiring Federal Reserve infrastructure or swap line negotiations. China tolerates Bitcoin mining when they need foreign currency and suppresses it when domestic energy becomes scarce. Both strategies serve statecraft rather than ideology.

Consider the current regulatory convergence: the GENIUS Act channels US stablecoin issuance through banks and licensed entities, while MiCA requires EU stablecoin issuers to become regulated e-money institutions. Private companies provide the innovation and bear the operational risk; governments maintain oversight and emergency powers.

I see no free market competition but state-controlled franchise operation disguised as private sector innovation.

The Cross-Border Settlement Wars

The real competition isn't happening in retail payments. It's in wholesale cross-border settlement where China's mBridge network competes with dollar-dominated systems.

Since Russia's invasion of Ukraine, cross-border wholesale CBDC projects have more than doubled to 13 active initiatives. Project mBridge connects banks in China, Thailand, UAE, Hong Kong, and Saudi Arabia for direct currency settlement without dollar intermediation.

Meanwhile, the US continues engaging in wholesale experiments through Project Agorá with six other major central banks, but avoids retail CBDC development that would threaten commercial banking deposits.

The pattern reveals strategic priorities: China builds alternative settlement infrastructure to challenge dollar hegemony. The US uses private stablecoins to extend dollar influence while avoiding domestic financial disintermediation.

Europe pursues both strategies simultaneously: the digital euro for monetary sovereignty, MiCA regulation to control private alternatives.

The Privacy and Surveillance Divide

CBDCs don't automatically enable surveillance, design choices determine government access. China's digital yuan tracks every transaction and enables spending restrictions by geography or category. The ECB's digital euro design includes privacy protections, offline transaction capability, and holding limits to prevent bank deposit flight.

75% of CBDC pilots now cite privacy and data protection as core design challenges. The Bank of England's digital pound consultation received extensive feedback on privacy concerns, while the ECB emphasises that the digital euro will "bring cash into the digital age" while preserving privacy features.

Private digital money faces different privacy trade-offs. Blockchain transactions are pseudonymous but permanently recorded. Stablecoin issuers implement KYC/AML requirements at onboarding but can't monitor peer-to-peer transfers directly. Governments access transaction data through exchange surveillance rather than direct monetary control.

The surveillance capability gap between Chinese CBDCs and Western CBDC designs may be wider than the gap between Western CBDCs and regulated stablecoins.

The Bank Disintermediation Problem

CBDCs create systematic risks that private stablecoins avoid: deposit flight from commercial banks. 53% of central bank regulators express concern that CBDCs could undermine commercial bank business models by offering deposit alternatives backed by central bank guarantees.

This explains holding limits in most CBDC designs. The digital euro may restrict individual holdings to prevent using CBDCs as savings accounts. Private stablecoins face no such constraints because they don't compete directly with bank deposits. They compete with cash and payment services.

Ironically, governments want monetary control but need commercial banks for credit creation. CBDCs threaten the banking system that monetary policy depends on. Private stablecoins preserve banking intermediation while extending monetary influence.

The Infrastructure Integration Reality

Private digital money already integrates with existing payment infrastructure in ways CBDCs struggle to match. Stripe cut transaction fees in half for stablecoin payments. PayPal offers 3.7% interest on PayPal USD holdings. Visa launched a platform for banks to issue tokens directly.

72% of central banks collaborate with private sector technology firms to build CBDC infrastructure, creating hybrid architectures that blur public-private boundaries. The technology gap is all about speed and user experience.

CBDCs must navigate regulatory approval, privacy frameworks, and international coordination. Private stablecoins launch features and iterate rapidly while maintaining compliance through existing financial regulations.

As a result, private systems advance faster while public systems optimise for stability and control.

Investment Reality Check

The bifurcated monetary system creates distinct investment opportunities:

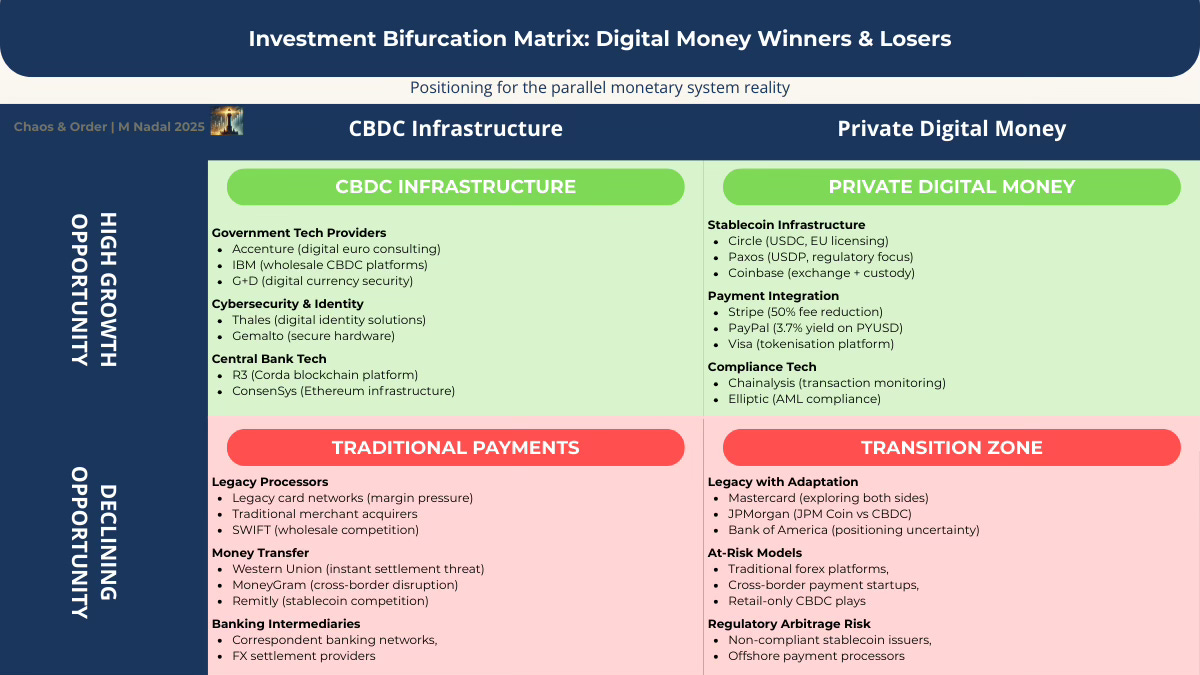

CBDC Infrastructure Winners:

Government technology providers with existing regulatory relationships

Cybersecurity firms specialising in digital identity and compliance systems

Hardware providers for offline transaction capability in emerging markets

Private Digital Money Winners:

Circle secured EU e-money licensing under MiCA, positioning for European expansion

Infrastructure providers enabling traditional banks to issue tokens and integrate blockchain settlement

Companies providing AI-augmented compliance and transaction monitoring services

Avoid the Disruption Trap:

Traditional payment processors face margin compression from both CBDC competition and stablecoin adoption

Money transfer services lose relevance as cross-border stablecoins provide instant settlement

Companies betting solely on retail CBDC adoption in markets where private alternatives already dominate

The Global Monetary Fragmentation

The competition between CBDCs and private money accelerates monetary system fragmentation rather than convergence. Countries with weak currencies face stark choices: allow citizens to use foreign CBDCs, foreign private digital money, or develop domestic alternatives.

Argentina, Nigeria, and Turkey show high stablecoin usage relative to regional peers, driven by inflation and exchange rate instability. But Nigeria also launched the e-Naira to reclaim monetary control. The result: competing digital monetary systems within single economies.

This fragmentation creates arbitrage opportunities for sophisticated users and systematic risks for governments losing monetary sovereignty to foreign digital currencies, whether state-issued or privately-issued.

What Comes Next

Neither CBDCs nor private digital money will eliminate the other. The outcome is a parallel system where different monetary tools serve different purposes:

CBDCs dominate: Domestic transactions, government payments, cross-border wholesale settlement between aligned countries, economies prioritising monetary sovereignty over efficiency.

Private digital money persists: International transfers, privacy-sensitive transactions, interactions across jurisdictions with conflicting regulations, economies prioritising efficiency over control.

The balance varies by country based on monetary stability, government capacity, and citizen preferences. But the fundamental tension remains: governments want monetary control, citizens want monetary freedom, and technology enables both simultaneously.

The US strategy of franchising private dollar stablecoins while avoiding retail CBDCs may prove more effective than direct government digital currency issuance. China's approach of state digital money with surveillance capabilities serves different political objectives.

Europe's dual strategy hedges against both approaches while maintaining flexibility.

The Bottom Line

The competition between CBDCs and private money revealed something important: governments can control monetary systems through regulation as effectively as through direct issuance. The GENIUS Act and MiCA frameworks turn private stablecoin issuers into state-controlled franchises while preserving innovation incentives.

This model may be more sustainable than direct government digital currency issuance because it preserves commercial banking intermediation while extending state monetary control globally. Private companies bear operational risks and regulatory costs while governments maintain oversight and emergency powers.

The strategic winner: whichever approach creates the most useful international payment infrastructure while serving domestic political objectives. Early indicators suggest the US franchise model may be more scalable than the Chinese state control model, but the European hedge strategy provides the most flexibility.

For capital allocators: position for parallel monetary systems rather than winner-take-all outcomes. The future is bifurcated by design.

Next in Chaos & Order

Edition 19: The Commodity Currency Wars - How oil producers and gold holders use new settlement systems to bypass dollar-based payments.

About the Author

Marjorie F. Nadal is Founder of M Nadal & Co and former Managing Director with 25+ years of experience building strategic operations across global commodities markets. She writes Chaos & Order, strategic intelligence for decision-makers who allocate capital and understand that monetary infrastructure shapes political outcomes. Subscribe for bi-weekly strategic analysis.

If you found this analysis valuable, share it with someone navigating monetary policy implications. Word-of-mouth drives independent intelligence.

📩 Want to discuss strategic briefings or advisory work? Contact me at mnadal@mnadalandco.com