Chaos & Order Edition 17: The Family Office Revolution

First in "The New Money Architecture" series

CHAOS & ORDER BY M NADAL SEPTEMBER 04, 2025

Disclaimer: This analysis represents personal observations and market intelligence. Views expressed are my own and do not constitute investment advice.

A few years ago, I watched a European patriarch fire his private equity firm mid-meeting. "Why pay someone 2% plus 20% to make decisions I can make myself?" he said. "I built a $2 billion business. I think I can manage a portfolio."

He wasn't complaining about performance, his assets had grown substantially under their management. It was just the recognition that he'd become wealthy enough to capture those returns himself.

That moment captured something bigger: ultra-wealthy families are cutting out Wall Street and taking direct control of approaching $5 trillion in global capital, double the $2.5 trillion they managed a decade ago.

Traditional asset managers delivered that growth, but in doing so, they created clients sophisticated and wealthy enough to eliminate them.

The shift is accelerating faster than most realise. In the past 18 months, I've advised three separate $500M+ families as they built internal investment teams. They're not just hiring analysts—they're poaching General Partners from established funds and offering equity stakes in their own platforms. The talent war is real, and traditional asset managers face an existential threat: their own success.

This is the first edition of "The New Money Architecture", examining how global capital allocation is being reorganised from the ground up.

The Mathematics of Rebellion

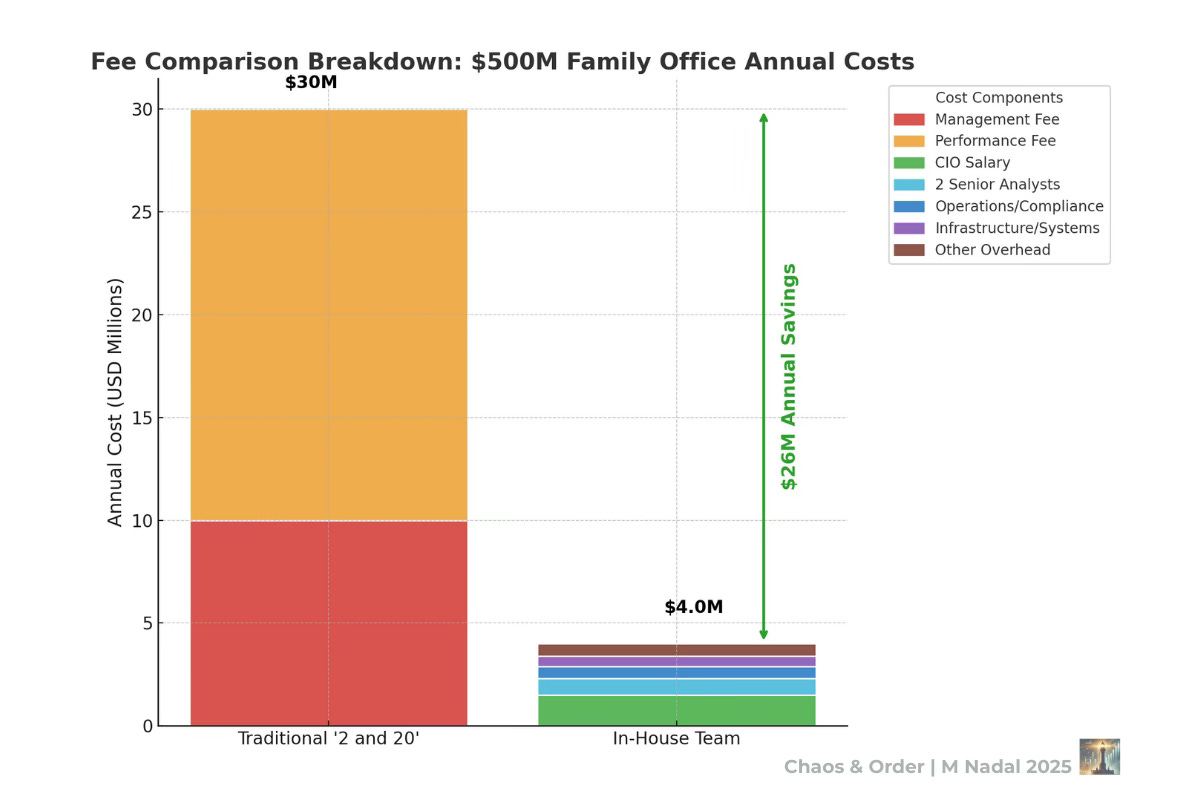

When you manage $500 million in capital, traditional asset management fees become mathematically absurd. A family office paying standard "2 and 20" surrenders $10 million in management fees plus 20% of any gains before seeing a penny of return.

Meanwhile, hiring your own investment team—including a CIO, analysts, and operational support—costs $3-5 million annually while maintaining complete control over timing, strategy, and deal selection.

But this goes beyond fee arbitrage. These families want board seats, operational influence, and direct relationships with management teams. Traditional funds offer quarterly reports and annual investor meetings. That's not enough when you're deploying hundreds of millions in capital.

🟢 The Mathematics of Rebellion

Direct Access Changes Everything

The shift resembles what I witnessed in commodity markets when electronic trading eliminated floor specialists. Once technology enabled direct market access, entire layers of intermediation disappeared overnight.

Family offices are applying the same logic: if you have sufficient scale, you can access the same deals, hire comparable talent, and negotiate similar terms as traditional asset managers—without sharing the returns.

A $500M European family office exemplifies this approach. When they invested $100M in a logistics company last year, they didn't want quarterly reports—they demanded a board seat and the right to install their own CFO. Traditional fund structures couldn't provide that level of operational control.

🟢 Cutting Out the Middleman

The Generational Advantage

Public markets think quarterly. PE funds think 5-7 years. Family offices think generations. That changes everything.

This fundamental difference in time horizon creates entirely different investment strategies. A family office can hold a concentrated position in a promising technology company for 15 years, weathering multiple business cycles that would force other investors to exit.

They can also structure investments across multiple jurisdictions, optimise for specific tax treatments, and pursue strategies forbidden to regulated institutional investors.

Market Impact and Price Discovery

When sophisticated money bypasses traditional funds, it breaks pricing across both public and private markets.

The effect compounds: every dollar that moves from public to private markets affects pricing in both.

Private assets become more expensive as family office capital competes for limited opportunities.

Public assets lose the consistent buying pressure that institutional investors traditionally provided.

We're seeing this most clearly in real estate, where family offices now own significant portions of prime London, New York, and Hong Kong properties previously held by institutional funds.

They're also increasingly competitive with traditional venture capital firms for access to promising startups, with over 80% planning further technology investments in the coming year.

Information and Influence

Traditional asset managers aggregate family office capital with pension funds, endowments, and other institutional money. Family offices lose individual influence and access to portfolio company management in these pooled structures.

Direct investment provides board representation, operational expertise from family business experience, network access to other opportunities, and information advantages from direct management relationships.

This fundamental shift in how ultra-wealthy families invest is creating massive opportunities for service providers.

The Infrastructure Response

Every Wall Street firm smells the $5 trillion opportunity. Executive search firms are charging 40% premiums for family office CIO placements. Custody platforms are racing to handle illiquid alternatives. Boutique advisory shops are sprouting up promising "governance solutions" for families who fired their asset managers but still need operational expertise.

Traditional asset managers are scrambling to adapt - creating co-investment platforms, acquiring family office service providers, anything to keep the mandates from walking out the door.

Regulatory Arbitrage and Future Constraints

Family offices currently operate under different regulatory frameworks than traditional asset managers. They face minimal disclosure obligations, can maintain concentrated positions, and enjoy flexible fee structures unavailable to regulated funds.

However, as family offices grow in scale and influence, regulatory scrutiny is increasing. As family office assets approach $5 trillion globally, they're entering territory that typically triggers institutional oversight requirements.

This creates a time-sensitive opportunity: family offices are racing to establish direct investment capabilities before regulators impose traditional asset manager constraints on their operations.

Investment Implications

Family offices bypassing Wall Street creates clear winners and losers.

Asset managers dependent on family mandates face secular decline as their clients bring investment capabilities in-house. Fund-of-funds—the ultimate middleman in an anti-middleman trend—are particularly vulnerable.

Meanwhile, the infrastructure providers win: custody platforms, reporting systems, executive search firms recruiting investment talent. Companies providing technology solutions for family office direct investment should benefit significantly.

But the bigger story is structural. When the world's wealthiest bypass traditional financial intermediaries, it signals the first crack in a much larger reshaping of global finance.

Looking Forward

Family offices cutting out Wall Street is just the beginning of a broader restructuring in global finance. The same forces driving this disintermediation—technology, scale, control preferences—are reshaping other aspects of the monetary system.

Next week, I'll examine how central bank digital currencies compete with private money for control of payment systems. The outcomes matter for everyone, not just central bankers, because they determine who controls the infrastructure that moves money around the world.

The pattern continues: technology enables direct access, intermediaries lose relevance, new power structures emerge. Understanding these shifts is crucial for anyone allocating capital in the years ahead.

Next in Chaos & Order

Edition 18: Central Bank Digital Currencies vs. Private Money - Second in "The New Money Architecture" series.

🔔 Subscribe for bi-monthly strategic intelligence assessments.

About the Author

Marjorie F. Nadal is Founder of M Nadal & Co and former Managing Director with 25+ years of experience building strategic operations across global commodities markets. She writes Chaos & Order, strategic intelligence for decision-makers who allocate capital and understand that market structure changes create the biggest opportunities.

If you found this analysis valuable, share it with someone navigating institutional capital allocation. Word-of-mouth drives independent intelligence.

📩 Want to discuss strategic briefings or advisory work? Contact me at mnadal@mnadalandco.com